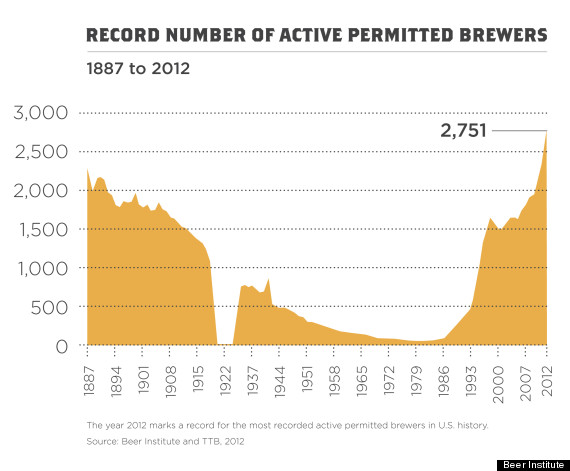

With the Brewer’s Association’s announcement that there are now more than 2,500 operational breweries, there has been a lot of buzz this year from pundits regarding a new craft beer bubble. The questions has come up more than once recently as to where maximum industry density is. It’s a fair question, albeit, in my opinion, premature.

While the BA’s numbers are impressive, the reported number of breweries is modest compared to the TTB numbers reflected in the infographic to the left. That 2,751 reflects the most active breweries in the United States since 1880 when there were 2,741. National production then was 13.3 million barrels of beer – up from 6.6 million barrels when the nation hosted 3,286 breweries only ten years earlier. Back in 1880 the population was a shade over 38.5 million people.

Currently, depending on whether you take the TTB or the BA numbers, there are currently 2,500 breweries, or there are 2,750-plus breweries in the United States. Those breweries, macros and micros alike, account for 200,028,520 barrels in beer sales in 2012. At the last census, we had 313.9 million citizens in our beer-swilling nation.

So, to give those numbers a little bit of context, we have, after hitting a low in 1983 when 51 “concerns” controlled 80 breweries. grown from the standpoint of the number of companies to a point not seen since around the time of the Civil War. In essence, there were 2.89 people per barrel of beer in 1880. Currently, that proportion is more in the neighborhood of 1.57 people per barrel of beer produced…well…if by currently, we’re talking last year’s numbers.

And, according to market statistics, overall beer sales were down by about two percent at the end of 2012.

Those certainly seem like numbers that are trending towards a bubble that is getting ready to burst.

And here’s why it’s not about to happen…

There are a number of things that didn’t exist back then, not the least of which is the macro element of the industry. I will come back to this point later. The macros are an important part of why the bubble isn’t about to burst.

Other things that breweries didn’t have back then also included refrigeration and distribution networks that exist today – these things essentially precluded the former point. Without refrigeration for long trips, the lagers which were popular back then couldn’t travel to other markets. With the inability to travel to other markets, breweries were largely limited to their own markets. That’s no longer true.

These days, even the smallest breweries can gain distribution outside of their home market, there are brewpubs bottling their beers, and people travel for special releases that they hear about through social media. And even with the ability to distribute farther than ever, craft breweries still cater to a “buy local” mentality from a large segment of their local market. All of these things contribute to a craft beer industry that grew by somewhere in the neighborhood of 16 percent last year, in spite of a down year in overall beer sales.

Is there a bubble that might actually burst? Sure. I don’t rule that out, however, here are some considerations –

When the craft beer bubble burst back in the late 1990’s, international distribution was limited, at best. The craft industry accounted for somewhere in the neighborhood of two percent of the market. The craft movement was almost non-existent overseas when the bubble burst, and the craft beer industry wasn’t taking market-share away from the macros.

That last item is key.

Sure, it’s a combination of issues – better distribution networks; overseas markets that didn’t previously exist; social media to promote beers and reach new drinkers; but most of all, craft beer has been eating into the macro market. Craft sales are up while overall beer sales are down – that means that the craft brewers are taking a significant bite out of the big boys. And here’s why the bubble isn’t about to burst – as long as the macros are out there, and right now the macros account for a little over 93 percent of the market, then there’s market-share to be had…or, more accurately, to be taken.

Tapped and Uncapped

We are going hoppy in today’s recommendation. I’m going with the Big Eye IPA from Ballast Point out of Cali. Pleasant notes of pine and citrrus bathe your tongue, while combining with a solid malt backbone. The beer is definitely worth taking a flyer on.

Until next week, be well, have a hoppy ‘Ale-o-ween, and drink good beer.

Slainte.

Aren’t you missing the word “million”, or is our very small group drinking an awful lot of beer?

“At the last census, we had 313.9 citizens in our beer-swilling nation.”

While I agree that the long-term outlook is good, I do believe that the current pace of growth is unsustainable. Between December 2010 and March 2012 the region of MN, WI, IL & IA saw an increase of 41% in the number of breweries. 41% in less than a year and a half. And the number of breweries continues to climb at something like that pace. True, the market for good beer is growing at double-digit percentages year over year, but 13-15% does not equal 41%. As the number of breweries continues to rise, it not only takes market share from the big boys, it also reduces the size of the pie slice for the small breweries, making it harder to compete.

Many of the new breweries coming on line are tiny nano-breweries, brewing 3-barrel batches or less. To compete at that scale is extraordinarily difficult. They rely wholly on extremely local markets to sustain themselves. And let’s be honest, many of them are making sub-par beer. As more and more breweries making high-quality beer open, will they be able to compete?

I believe that we will see a short-term correction, followed by a long-term period of slower, more sustainable growth. But who knows. Only time will tell.

thanks for the catch. Fixed.

I do agree, the pace of recent growth has been ridiculous, and yes, it is likely that it will slow down. Part of the issue leading to the initial craft beer bubble in the ’90’s was the fact that there were a number of breweries that were making beer that was significantly less than stellar, and yes, that still exists, but there are also a number of other factors at play in creating the larger market, not the least of which include both a much larger homebrewing culture, and the rise of beer weeks.

As for the math with the macros accounting for almost 94 percent of the market, I think it’s going to be a while before that pie is too small for the micros to share. The 41 percent growth rate – yeah, that’s a special sort of ridiculous. It has to slow down. I think in the end, the craft industry’s growth rate will be slowed by two things – the retirements of the founders of some of the oldest retiring, and in many cases, selling to the macros (which I think might become holding companies for a number of craft breweries, ie: Boulevard, Goose Island), and just natural market correction. I think it’s possible that the industry will continue to grow aggressively for a couple of years yet (there are still too many states with almost no brewing that are ripe), possibly into the neighborhood of eight to ten percent of the market before it slows down to a more modest rate of growth.

Honestly, I think that issues other than the basic quality of the beer are more likely to derail and slow down the industry’s growth – and that’s access to ingredients. As the industry grows, and the macros continue to merge, it creates a set of circumstances wherein the macros could end up controlling large segments of the grain supply, or issues like wildfires from a couple of years ago could grievously injure the smallest brewers to the point of closing. Mother Nature…she’s a b^%$#.